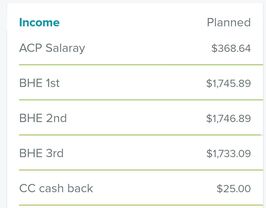

It took my husband and I two years to become debt free. We paid off over $132,000 which didn't even include our house. It was student loans, credit cards, and a vehicle loan. We worked three jobs each and put almost all of our extra income towards debt with the goal to live the life we wanted to. We couldn't do that with debt looming over our heads. We chose to follow Dave Ramsey's principles but there are a ton of people out there to check out. I am sharing the simplest way we got out of debt which starts with getting on a budget. How can you pay off stuff if you don't know how much you are bringing in or spending? It would just feel like treading water all the time versus actually moving forward. Start with figuring out what income, expenses, and debt you have. That is the simplest way to begin. Some people prefer to do all of this in an excel sheet and update it each month. That never worked for me because I didn't keep up on it and by the time the end of the month rolled around I had no idea what I spent, what I bought, what category it was in, and if I had anything left over. And that was with tracking from a debt or credit card. Don't even get me started on cash. It was a nightmare and I always felt so defeated. So when I saw the Every Dollar app was free and would track ALL my expenses for me, I was willing to try again. Please note we are not affiliated in anyway with any of the companies I am talking about in this article. I am genuinely sharing what worked for my husband and I! Microsoft Office Excel is a great tool to use on a macro level to list all of the debt you have. Then every 3 months you can update what you have put towards debt so you can see the progress you have made. But using a budget app is the key (for us anyway) to track all of your expenses on a micro level. It doesn't matter what app you use but for people on the go, you have to track your expenses EVERY SINGLE DAY or every other day. Once you get behind it is very discouraging and hard to catch up. And once you get used to tracking every time you make a purchase it will become second nature. INCOMESAVINGSYou should have a $1,000 emergency fund built up. If not, work on that first. If you have an emergency fund than all of your extra income "should" be going towards debt - per Dave Ramsey's principles. We never found that very practical because we still want to go on vacation or buy gear or whatever. So we would put money away from each paycheck if we knew we had something coming up. But we didn't do any extravagant trips. We would save for gas and tent spots or back country permits to do a road trip to go backpacking or to go skiing with friends and rent a place through Airbnb. We were very intentional with budget vacationing so we weren't setting ourselves too far back from our debt free goals. EXPENSES

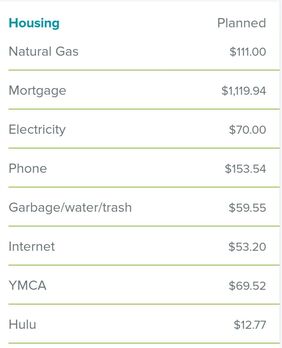

INSURANCE & TAXThe best is to pay your premiums in full rather than breaking them out per month since you will save more. We would do that and then save up for the next premium. For example: I know we have our car insurance of $400 every six months. I would divide that by six and put $66.66 each month into savings. You can do that for anything you know is coming up DEBT

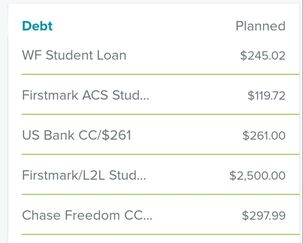

You do want to be paying the minimum payments on all of your debts as well as putting anything extra towards the smallest debt. In this example, you can see three student loans and two credit cards listed. All of the amounts listed are the minimum payments due for that month except for the "Firstmark/L2L" where much more than the minimum payment is being made, thus that is the debt with the smallest balance. Below is a general example for reference: Example: Credit card A: Owe $5,000 Minimum payment: $52 Credit card B: Owe $1,000 Minimum payment: $30 Student loan A: owe $24,000 Minimum payment: $175 Student loan B: owe $13,000 Minimum payment: $95 Student loan C: owe $750 Minimum payment: $23 Car loan: owe $4,500 Minimum payment: $121 In this example $496 is going towards minimum monthly payments on all of the debt. You can put the remaining $504 towards the smallest debt which would be Student loan C. To begin with figuring out the debt you owe:

WORDS OF ADVICEDon't expect that you will stick to your budget 100% each month just the way you planned it out at the beginning of the month. Life happens. Unexpected things come up. But if you know where your money is going you can tweak what amounts are being spent in which categories so you can easily update and change the amounts when you need to.

For example: Let's say I allocated $50 towards cloths for the month of August. But then my dog got sick and her medicine cost $25 but I hadn't allocated funds for my dog besides the $50 each month I spend on a bag of dog food. I would then readjust my budget amounts for cloths to be $25 instead of $50. And increase my pet budget to $75 instead of $50. In addition, it will take you a few months to get the hang of budgeting. It is extremely eye opening how much you actually spend (and make) when you break it down. Remember that Rome wasn't built in a day thus it takes time for change to happen and to stick with it. Don't seek perfection, just do the best you can and each month your spending will better align with your budgeting goals! Lastly, learn how to say "no". You can't get out of debt if you spend money whichever way is fun, easy, and luxurious. Save that for when you are out of debt. Living on a budget is hard. You have to make sacrifices and continually refocus on what your priorities are. Many people will try and deter you. We do not live in a society that is debt free. The average American household credit card debt is $5,700, that doesn't event include student, vehicle or mortgage loans. If you can't surround yourself with people who understand what you are doing than at the very least follow people on social media who do or listen to podcasts that talk about getting out of debt. The positive reinforcement makes a huge difference, is an encouragement, and helps to see you are not alone in the struggle. Good luck and check out the article from January we wrote about our debt free journey! Blog post written by Amy Karras Unnamed Adventures

2 Comments

10/3/2019 06:58:42 am

Hi, I liked your post, most useful, informative & Well-maintained. keep it up.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorsFor the love of travel and new adventures, we live our lives for the next dream fulfilled! Categories

All

Archives

August 2021

|

|

|

Our Hometown of Rapid City, South Dakota |

RSS Feed

RSS Feed